Avoid This Costly Mistake When Using Forex Indicators (RSI): Understanding Divergence in EUR/AUD Trading

- ravz01

- Mar 25, 2024

- 2 min read

In the world of forex trading, indicators serve as invaluable tools for interpreting market dynamics and making informed decisions. However, relying solely on indicators without a comprehensive understanding can lead to costly mistakes. One such pitfall is blindly following divergence patterns, as demonstrated in the case of EUR/AUD trading. In this blog post, we delve into the intricacies of divergence, how to recognize it, and most importantly, how to avoid potential losses by incorporating additional confluences and risk management strategies.

Understanding Divergence:

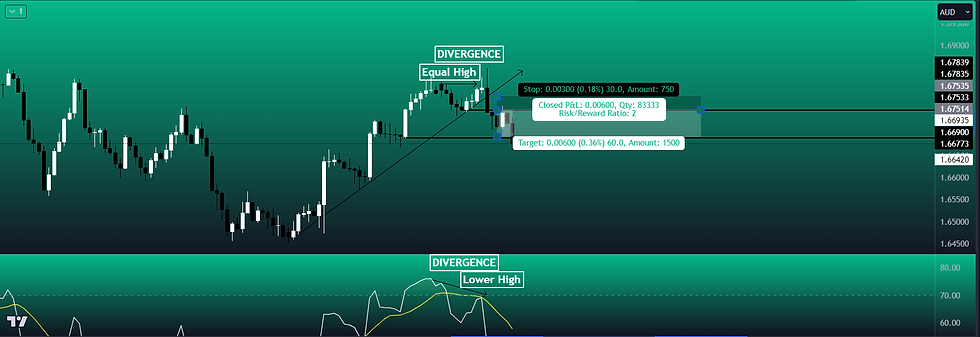

Divergence occurs when the price of a currency pair moves in the opposite direction of an indicator, signaling a potential shift in market sentiment. For instance, in the case of EUR/AUD, equal highs in price coupled with lower highs in the Relative Strength Index (RSI) indicate bearish divergence. This suggests a possible reversal from an uptrend to a downtrend.

The Pitfall: While divergence patterns offer valuable insights, they are not foolproof indicators of market direction. Traders who blindly rely on divergence without considering other factors may find themselves vulnerable to false signals and unexpected market movements.

In the case of EUR/AUD, relying solely on bearish divergence without additional confirmations could result in premature entries or stop-loss hits, leading to losses.

How to Avoid the Pitfall: To mitigate the risk associated with divergence trading, it is crucial to incorporate additional confluences and risk management strategies. Here’s a step-by-step approach:

Confirm Divergence: Begin by identifying divergence between price and the chosen indicator, such as the RSI. Verify that the divergence pattern aligns with your trading strategy and timeframe.

Seek Confirmation: Look for additional confluences that support the anticipated market direction. This could include a break of the previous low in price or a break of an uptrend line, providing further validation of the reversal signal.

Implement Risk Management: Before entering a trade, calculate a suitable risk-to-reward ratio to protect your account. This involves determining the potential profit target and setting stop-loss orders to limit losses in case the trade goes against you.

Exercise Patience: Avoid rushing into trades based solely on divergence signals. Exercise patience and wait for all necessary confirmations to align before entering the market.

In the exact same example EUR/AUD exhibits bearish divergence, with equal highs in price and lower highs in the RSI. To validate this signal, you observe a break of the uptrend and a break of the previous low (First balck line) in price therefore giving you a confirmed downtrend. Additionally, you calculate a favorable risk-to-reward ratio (1:2 risk to reward), ensuring that potential losses are minimized.

While divergence patterns can be powerful indicators of market reversals, they should not be used in isolation. By incorporating additional confluences and practicing effective risk management, traders can enhance the accuracy of their trading decisions and avoid costly mistakes. Remember, patience and diligence are key when navigating the complexities of forex trading.

Comments